About Chatham Lodging Trust

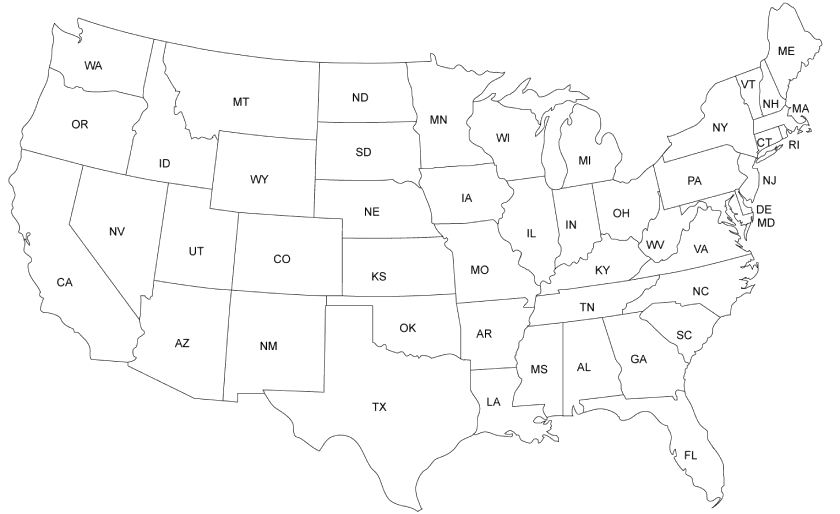

Chatham Lodging Trust is a self-advised, publicly traded real estate investment trust (REIT) focused primarily on investing in upscale, extended-stay hotels and premium-branded, select-service hotels. Our high-quality hotels are located in major markets with high barriers to entry, near primary demand generators for both business and leisure travelers. Our primary objective is to generate attractive returns for our shareholders through investing in hotel properties at prices that provide strong returns on invested capital, paying meaningful dividends, and generating long-term value appreciation. The company owns 36 hotels totaling 5,475 rooms/suites in 15 states and the District of Columbia.

Disciplined Growth Strategy

Chatham is focused primarily on investing in upscale extended-stay hotels and premium-branded, select-service hotels

Opportunistic hotel repositioning: We intend to employ value-added strategies, such as re-branding, renovating, or changing management when we believe such strategies will increase the operating results and values of the hotels we acquire.

Aggressive Asset Management

Although as a REIT we cannot operate our hotels, we will proactively manage our third-party hotel managers in seeking to maximize hotel operating performance.

Our asset management activities will seek to ensure that our third-party hotel managers effectively utilize franchise brands’ marketing programs, develop effective sales management policies and plans, operate properties efficiently, control costs, and develop operational initiatives for our hotels that increase guest satisfaction.

As part of our asset management activities, we will regularly review opportunities to reinvest in our hotels to maintain quality, increase long-term value and generate attractive returns on invested capital. For example, we have taken excess land in Mountain View, California and added 32 rooms. We transformed a seldom used meeting room in Savannah, Georgia and opened a highly successful restaurant and bar, Toasted Barrel. We modernized excess public space into bars in Anaheim, California, as well as Bellevue, Washington. Additionally, we have converted excess meeting room space into higher earning guestrooms in multiple locations across the portfolio. These are accretive investments that deliver added value to our properties and ultimately our shareholders.

Responsibility

Ethics and Governance

Social Responsibility

Environmental Stewardship

Our Commitment

Our Brands

We expect that a significant portion of our portfolio will consist of hotels in the upscale extended-stay segment, including brands such as Residence Inn by Marriott®, and Homewood Suites by Hilton®. We invest in midscale extended-stay brands such as Home2 Suites by Hilton and TownePlace Suites by Marriott as well premium-branded select-service hotels such as Courtyard by Marriott®, Hilton Garden Inn®, Hampton Inn® and Hampton Inn and Suites® as well as Hyatt Place.

Portfolio

Our hotel portfolio prominently features extended-stay accommodations as well as premium-branded select-service hotels. We have the highest concentration of extended-stay rooms of all lodging REITs. Emphasizing strategic growth, we target markets with robust demand drivers and anticipate demand to outpace supply. We strategically acquire properties with potential for improved management and capitalization, while selectively pursuing new hotel developments where exceptional risk-adjusted returns are foreseeable.